I received a newsletter from Darcy on nominating guardians for your kids, and thought it was worth sharing, though it’s not really one of my normal topics. But I’m sure many of you have children, and if so, this is interesting.

Being a Superhero to Your Kids

The Importance of Nominating Guardians for Your Children

by Darcey L. Wong, J.D., LL.M. (Estate Planning)

It’s beyond science fiction! The instant you become a parent, the universe shifts and the center of it lies in your hands. You gather super-human strength to survive sleepless nights, you set-up routines for feeding and diapering, you find ways to contain (or not) toddler energy with their safety in mind every time you spy a sharp corner, uneven pavement, or the dangers of the Target parking lot! You thought you survived becoming a new parent, and then you discover school is really part-time, AYSO soccer stands for “All Your Saturdays Occupied”, daily practice makes perfect, and to protect themselves from bullies they need martial arts classes! What? And there’s more… birthday parties, homework, chores, quality family time, instilling good values, healthy eating, and getting enough sleep (for the kids– you already sacrificed that for yourself!). You do it all (or everything that counts), somehow, and live to save the day again, tomorrow, and the next day.

But who will save the day, every day, like you do, if you become incapacitated or pass away? Statistics show that even superheroes are not immune from the common car accident, fatal medical issues, and other unpredictable injuries or accidents leading to an untimely passing.

Too many parents put off estate planning that addresses the care of their children, ignoring this important necessity because they feel young and invincible, or don’t think they have enough of a financial “estate” to warrant estate planning, or just don’t have any more superhero strength left in them to give it the proper attention. Some may assume that if anything happened, the other parent will survive and take care of the kids, or other family members would step right in and handle everything.

But it’s not easy filling the shoes (or boots) of a superhero. Failure to plan for unexpected incapacity or death of both parents puts your kids, their well-being, and their future at risk.

Without a good estate plan some disturbing situations may be more likely:

- Your children could be placed with Child Protective Services. Even if it’s temporary, this is something that no parent would ever want for any child.

- A judge will decide who will raise your children based on minimal information about your wishes, which may be grossly misrepresented after your death. Though a judge will ultimately determine your child’s guardian (no matter what planning is done), with a good estate plan the judge will know your wishes for your “back-up superheroes” for your kids, as well as who you would not want involved.

- Your children could be cared for by someone you’d never choose. It could be a family member with good intentions, but who you wouldn’t even want raising Underdog (your canine sidekick), nonetheless your kids, because their morals, values or lifestyle are completely different to yours.

- Your children and entire family could find themselves in a long, drawn-out custody fight over who will be the guardian with no clear solution in sight.

- There could also be a court battle over who will control your children’s assets.

- Control of your family business, the family home, or other valuable assets could cause unnecessary conflict, and key assets could be mismanaged or sold out of the family when you intended to keep them for your children as your legacy.

- The children end up fighting amongst themselves over your assets or blowing their entire inheritance after they turn 18 years old when they gain full control of it.

- Unscrupulous guardians (think Lex Luthor) could come forward to take custody of your children, only to squander the assets.

These are some disturbing scenarios that are unfortunately not make-believe. It’s heartbreaking to see families torn apart in epic battles of alleged “good versus evil”, fighting over children and money, even while knowing the parents would not want this in a million light years.

There’s Rarely a “Good Time” to Plan

When you are flying/driving cross-town saving the day over and over, you probably don’t feel like you have the time or money to meet with an attorney to plan. But even if you got a little bonus and free time, you may want to pay down your mortgage first or take a vacation. Or maybe you don’t think you have a large enough estate to justify spending money on an estate plan. (If you have more than $150,000 you may be subject to probate in California, and don’t overlook the value of a Bay Area home and the impact of life insurance proceeds.) Or maybe you think estate planning is something you can do later (when you’re “old”)—in your late 40s, 50s or 60s.

The truth is that there’s rarely a “good time” to plan. Life gets in the way. But even superheroes don’t take totally unnecessary risks. Failure to plan for unexpected incapacity or untimely death puts your kids, their well-being, and their future at risk. Go save the day, beyond your days, by calling me to start putting an estate plan in place now to protect your children when you are not there to do so.

This was prepared by Darcy Wong, who can be contacted at:

Darcey L. Wong, J.D., LL.M. (Estate Planning)

Law Offices of Darcey L. Wong, P.C.

dwong@sfestatelawyer.com

Tel 650.578.0300

Fax 650.240.3905

www.sfestatelawyer.com

Published with permission of the author.

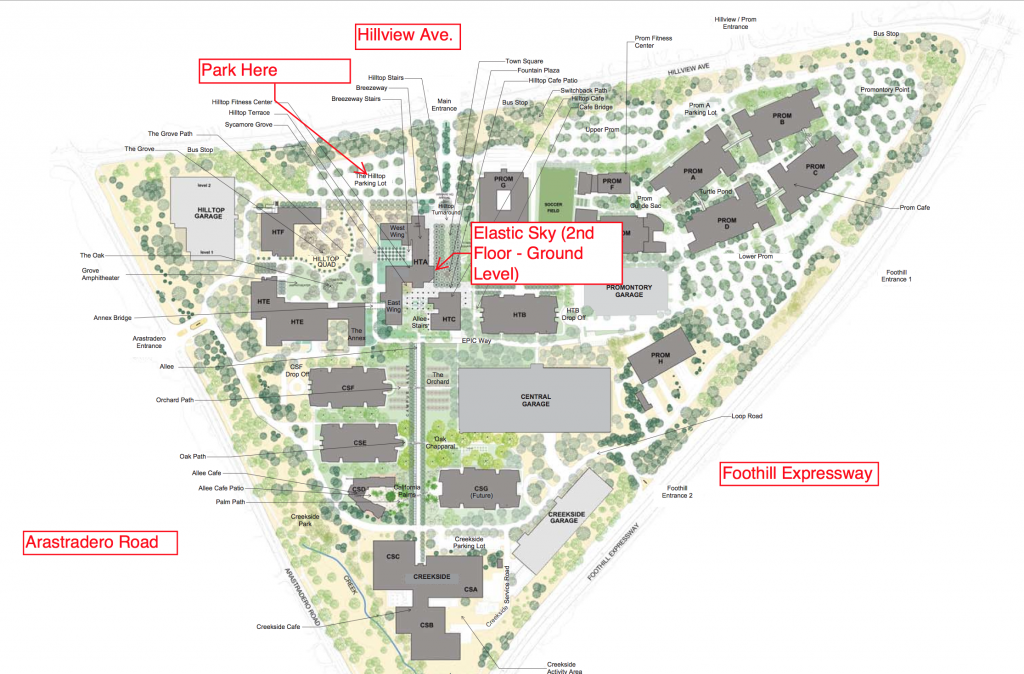

I’m on the Board for an amazing non-profit, Science is Elementary and am co-hosting a “kid-encouraged” casual party this Sunday, May 15th, at 2 p.m. in Los Altos.

I’m on the Board for an amazing non-profit, Science is Elementary and am co-hosting a “kid-encouraged” casual party this Sunday, May 15th, at 2 p.m. in Los Altos.